STRONGER WITH ITS NEW PARTNERS

KATMERCİLER, WHICH WENT PUBLIC IN OCTOBER 2010, TRUSTED IN TURKEY’S GROWTH POTENTIAL AND AS THE RECIPROCATION TO THIS POTENTIAL SHARED ITS PROFIT WITH STAKEHOLDERS.

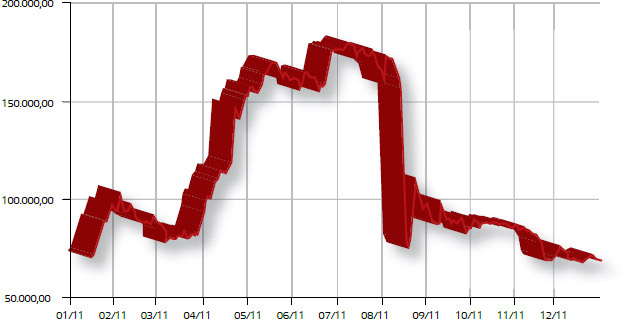

UNCERTAINTIES in global finance markets and the deadlock in Europe’s debt crisis identified last year. The year 2011 began with the expectation, that global crisis’ impact would be weakened, but it soon fizzled out. In US FED continued the expansion of money supply, which led high increase in global risk appetite. But with the eruptions of successive crises in Europe liquidity expansion slowed down and high volatility dominated second half of the year. Especially Greece’s debt crisis terrified the finance markets. Despite the storm in global markets Turkey maintained its strong standing and weathered the crises relatively unscathed. Especially first half of the year witnessed Turkey’s high growth rate and expansion of its influence in the region. In the last quarter uncertainty in global markets also had negative effects on Turkey’s economy and export. However in 2011 GDP growth exceeded 8 percent and total exports increased 18.5 percent.

JOURNEY TO SUSTAINABLE PROFITABILITY

For Katmerciler its first public listing experience was one of the most exciting events of the year. In public offering or IPO, arranged in November 2010 by Deniz Yatırım, demand tripled the level of supply, so 24 percent of the company’s shares went public. Between Nov. 3 and 5 by book building 3 million shares offered to public at a fixed price of 6 Turkish Liras per share. On Nov. 11 they started to trade on İMKB. İMKB (Istanbul Stock Exchange) and SPK (Capital Markets Board of Turkey) have started a campaign that aims to increase interest in IPOs. Katmerciler, which became the bearer of this campaign, is using IPO proceeds to finance planned investments and to consolidate company’s financial structures. Both material and moral force provided by public listing are carrying Katmerciler closer to its goals of ‘becoming an international brand in 2015’ and ‘sustainable profitability’.

AS THE FIRST vehicle equipment producer traded at İstanbul Stock Exchange (İMKB), Katmerciler made a strong entrance with incentives like buyback guarantees and bonus shares which were used for the first time in Turkey. The aim was encouraging long term investments, protecting and rewarding long term thinking investors.

As part of IPO incentives, investors, who kept their shares 90 days from 11 November 2010 to 8 February 2011, were entitled to earn additional 5 percent in bonus shares. Their 35,833.30 TL nominal priced shares are distributed to their accounts as of 22 February 2012. Bonus shares calculated according to the records of IPO shares buyers in Central Registry Agency and transferred automatically to investment accounts. The investors didn’t need to take any action to receive bonus shares. Bonus share incentive was valid only for IPO shares and wasn’t applied to shares purchased in İMKB after company’s shares traded there.

11 MILLION TL CAPITAL BEFORE THE IPO

According to legal procedures to be followed in buy back guarantee, the date of transferring bonus shares to accounts, was announced previously as 28 February 2011, but brought forward to 22 February. Because while share price was rising, no appeal had been made under buy back guarantee

2011 PERFORMANCE OF THE STOCK

In 2011 instability in global markets and crisis environment effected also İMKB. Sharp fall of shares, beginning from august, reflected also on Katmerciler’s stock (KATMR). After the decline, which continued until the end of the year, KATMR began to recover in the first months of the new year.